Thursday, September 8, 2011

Google Offers rolls out to five new markets

As Facebook kills its Deals business and Groupon faces heavy criticism, Google Offers trucks along.

Shortly after Facebook shuttered its Deals platform and Groupon was said to postpone its IPO indefinitely, Google announced that Google Offers is doing great! So great, in fact, that it’s expanding to five new markets: Austin, Boston, D.C., Denver and Seattle.

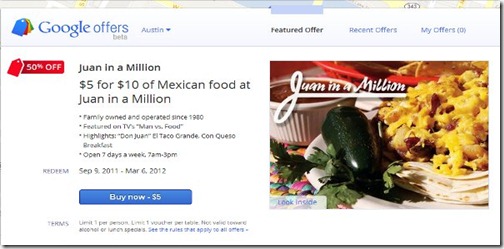

The company launched Google Offers in June, starting with a beta release in Portland, which was followed with rollouts to New York City and San Francisco. Today’s deals include $5 for $10 worth of Mexican food in Austin, $5 for $10 worth of ice cream in Boston, $3 for $6 worth of falafel in D.C., $5 for $20 worth of books in Denver, and $9.50 for a $19 ticket to the Seattle Aquarium. All of the deals will be redeemable as of Thursday, September 8.

The announcement came less than two weeks after Facebook announced its plans to kill its own Deals business after just four months of testing. "We think there is a lot of power in a social approach to driving people into local businesses," Facebook said in a statement. "We've learned a lot from our test and we'll continue to evaluate how to best serve local businesses."

The social networking giant had been running deals in five cities with the help of its own sales team, while also curating deals from other daily deal sites like Gilt City and ReachLocal. In the end, however, Facebook was like a fish out of water, since the daily deal/group buying space is only playing at being social. It’s just not social the way Facebook is social.

Google Offers was first hinted at months ago, shortly after Google attempted to buy Groupon for $6 billion and was sorely rejected. These days, Groupon is facing a bit of a rough patch. CEO Andrew Mason maintains that Groupon has never been stronger, but the company has had to delay its IPO due in part to the rocky stock market, but it seems likely that mounting criticism of Groupon’s business model and scrutiny from the SEC have played a role as well. A leaked memo from Andrew Mason outlining the company’s strengths has some accusing the company of violating the “quiet period,” which could further complicate the IPO.

Technology trends and news by Faith Merino

September 7, 2011 | Comments

Short URL: http://vator.tv/n/1ead

Your post really helped me to understand about this. It has great details and yet it is easy to understand.That's what i was looking for. I will definitely share it with others.

ReplyDeleteThanks for sharing.very nice.... i like this posting.I figured you'd come up with it yourself if I delayed long enough! :) Glad I got in there in time to help you out.

vps hosting reviews